Now accounting for over two-thirds (68%) of all radio listening, digital radio has maintained its predominant position according to the latest Radio Joint Audience Research (RAJAR) figures for Q1 2022.

The latest figures also reveal that all radio, once again reached 89% of the adult (15+) population on a weekly basis in this quarter – the same as the last. The total average number of weekly hours listened to radio for this period is 1.012 billion.

Digital listening remains popular with 75% of the population tuning in each week. In terms of reach, 42 million UK adults aged 15+ are now tuning in to radio via a digitally enabled platform (DAB, DTV, Online, App or Smart Speaker) each week, and 66% of the population claim to own or have access to a DAB radio.

32% of respondents (adults 15+) claim to listen to Live Radio via a Smartphone or Tablet at least once per month.

DAB has a 41% share of listening

Most listening still occurs via DAB, with 41% share. Online listening is also creeping up, growing to a high of 22% share, including websites/apps (12%) and smart speakers (10%). AM/FM listening hours are slightly lower than the previous quarter (35.6%) with less than a third share (32%).

When looking at an average week of listening, digital listening accounts for a total of 688 million hours:

- DAB has a 60% share of digital listening hours

- Website/apps have 18%

- Smart speakers have 15%

- DTV has 7%

This Rajar data is the first to include details on listening via smart speakers including Amazon Echo, Apple HomePod and Google Chrome, taking up almost half of online listening (10%).

Most people are tuning it at home, with a 65% share, reaching 68% of the population.

The audio landscape is “thriving”

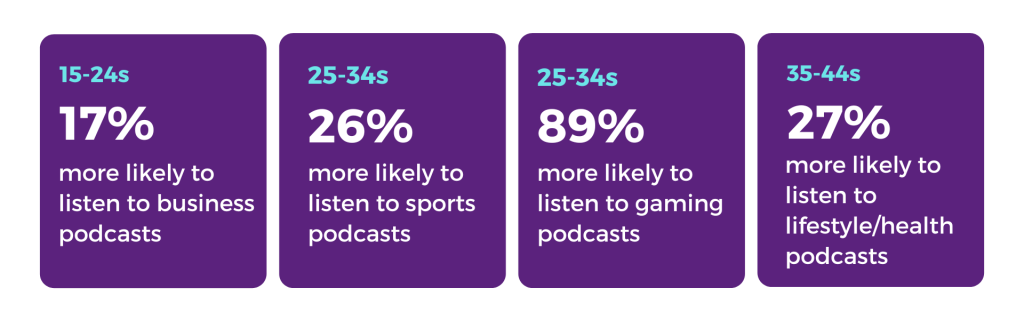

With all radio listening encompassing 89% of the UK population weekly, and podcasts having approximately 23 million UK listeners monthly – the audio landscape is “thriving”, says Mediatel. When taking a closer look at listening activity by age group, Mediatel data reveals that:

- Whilst podcasts are popular amongst the three youngest age groups, over-indexing at 135, 135 and 136 respectively, respondents aged 55-64 and 65+ are yet to adhere podcasts, despite extremely fast growth, under-indexing at 55 & 51 respectively.

- For live radio listening, the eldest age group were over-indexing at 115 and 16-24s were under-indexing at 70.

“With such differences in trends between age groups it will be interesting to see how the audio market develops over the years to come.” added Mediatel.

Podcast listening by age group

TGI data also reveals that ages 15-24 are 92% more likely than other age groups to agree that podcasts improve their perception of a brand, whilst 15-24’s are 78% more likely to agree.

All Response Media viewpoint

“The latest RAJAR figures show that radio is still an effective medium, and its role remains important to advertisers. Radio consumption has developed as new ways of listening have been introduced, such as smart speakers, and it seems the industry is continuing to welcome these changes.

65% of radio listeners are tuning in at home, up slightly from last from the last quarter, which could mean opportunity for listeners to react to messaging. Of course, as with any advertising campaign, the use of radio will be dependent on the objective, whether that’s brand presence, delivering a performance metric or a combination.

At ARM we continue to explore radio and how to measure its success on our clients campaigns on both response and awareness metrics. With all radio listening encompassing 89% of the UK population on a weekly basis, it allows us to add cost-effective reach to any other media channel being used.”

Helen Gray

AV Account Director

FEATURED READS