DEADHAPPY | CASE STUDY

Generating immediate return on investment and scaling the DeadHappy brand across the UK.

+250%

Brand Awareness

+200%

Sales Uplift

67%

Unique VOD Reach

DeadHappy serves people on lower income; a group often ignored by the traditional life insurance market. Their product is designed and marketed to make it easy, affordable and appealing to get cover. DeadHappy’s brand leans on hard-hitting and irreverent creative to disrupt an otherwise grey life insurance category.

As a relatively new entrant in a market with many legacy brands, standing out was only one piece in the jigsaw. ARM and DeadHappy had successfully scaled direct response TV from £50k per month to £250k achieving cost per acquisition and volume targets. DeadHappy challenged ARM to create a test which would determine the impact of investing above the direct response ‘efficiency ceiling’ to prove that there was room to scale their business.

The challenge

Minimise the impact on ROI in the short term whilst broadening the marketing mix, to include media which would not typically be regarded as DR.

The solution

Follow the data, pull the thread.

DeadHappy’s primary target market is circa 2.2m individuals in the UK. With a relatively niche target audience, taking a national approach to deliver a high reach multi-touchpoint campaign would be a high risk tactic.

DeadHappy and All Response Media identified the Northern regions as being a blend of best value media pricing and highest audience efficiency. TouchPoints data was added to enrich the target audience, highlighting the potential media mix.

Kris Archer

Business Director

All Response Media

“The most difficult and brave choice of all , was to risk including other media, or double down on regional TV. The cost of regional TV compared to daytime DTRV prices would be too much to deliver on our goals. To succeed the strategy would have to combine broad reach, low-cost media to raise awareness, with performance TV driving the responses and sales.”

To remove any cognitive bias that the planning team might have had, the media channels were scored across 7 different variables to determine their suitability to deliver on the objectives. This is an extended version of the Suitability, Acceptability, Feasibility (SAF) framework. This process enabled us to order the candidate media channels based on data, in this order: TV, Door Drops, BVOD, Outdoor and Radio.

Touchpoints enabled us to further optimise the media placements. A key piece of insight was that for the target audience, the breakfast peak in radio was more important than the drive peak. This enabled us to deliver a better exit CPT against our target audience.

Our insight also showed us that people were more likely to respond in the morning compared with the afternoon – the hypothesis being that people were in an ‘action’ state of mind in the morning, compared with a ‘relax’ state of mind towards the end of the day.

The campaign relied on launching with posters, whilst using the door drops to convert after waiting until the coverage had been built, maximising the chances that people had been exposed to the campaign.

The results

5 x budget growth.

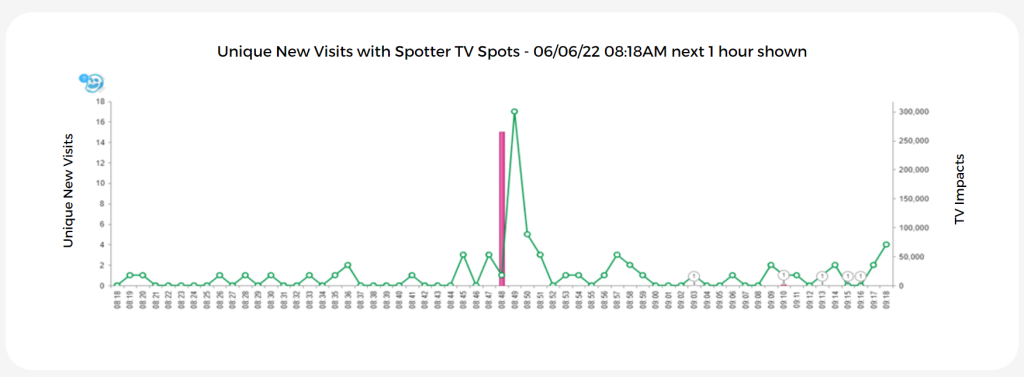

DeadHappy saw a 200% sales uplift in the test areas, compared with the 79% set by control areas. Adsmart delivered 80% reach of the target audience, particularly reaching light TV viewers. Over half (67%) of our VOD reach was unique; people we wouldn’t have reached through our TV campaign had we not had this live. Regional TV delivered large spots, driving immediate increased visits to site:

Brand Awareness increased by 250%, growing in exposed regions, demonstrating campaign success in moving the dial for brand health. Across the competitor set, we saw the best PoP consideration growth. Ad Awareness in exposed regions doubled from 4% to over 10% post campaign according to YouGov data.

Lucy Holton

Head of Growth

DeadHappy

“Our relationship with ARM is truly collaborative. They are analytical and reactive. This specific campaign was strategically focused and fundamentally insightful, which now allows us to scale for 2023 with confidence, and at pace“

Get in touch

Check out our online and offline services, or contact the team today to find out how we can combine TV and data science expertise to get the most out of your advertising budget.

FEATURED READS

TV:

DIGITAL: