Spain provides an excellent set of TV and media advertising conditions to quickly gain market share and ensure growth through specialist media planning.

Posing a commerce opportunity with a population of almost 47 million, Spain is the fourth most populous EU member state and also ranks fourth for GDP; an important part of the European market and essential to consider as part of your European expansion plans.

The Spanish TV advertising landscape

- TV reaches an average of 85% of the Spanish population per week, a figure that has remained stable since 2019, & the highest reach of any media including ‘Internet’ at 80% (Source: TV Key Facts, 2020).

- All Response Media have achieved 30” CPTs as low as €1 during lockdown periods (lowest in 2020). CPTs remained at €2-€2.50 throughout 2021, 4-5x lower than some other European markets, and 30-40% cheaper than other major European TV markets (Source: ARMalytics, RAPS, 2021).

- 87% of video viewership in Spain is ‘live broadcast TV’. All video viewership, including time-shifted viewing, short-form OLV (Youtube and Facebook), and long-form OLV (Broadcast VOD), is the second-highest % in Europe according to RTL’s TV Key facts 2020. This highlights the potential to quickly drive reach and see immediate web uplift.

- TV Viewership in Spain was the second most sensitive to lockdown conditions in 2020. Viewership increased by an incredible +80 minutes on average per day in March 2020, and remained up YoY in all months. Total TV viewership on average per day is a very high 4 hours (Source: TV Key Facts, 2020).

- Whilst pricing dropped significantly during lockdown periods, YoY Q4 2021 equivalent CPT/Cost per GRP remains very stable – so pricing opportunities continue post-COVID (Source: TV Key Facts, 2020).

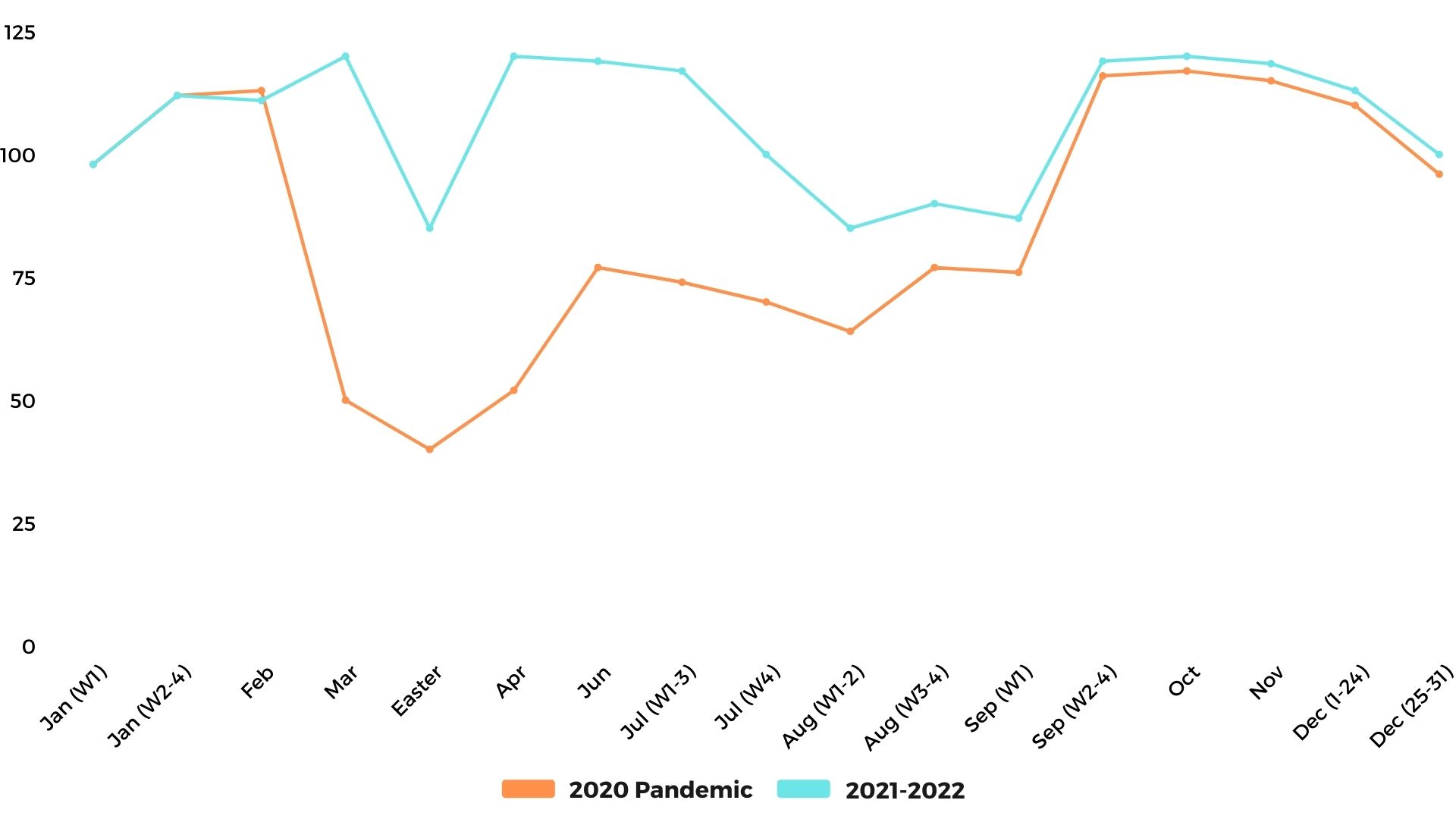

Cost/GRP Index Fluctuation by Months

2020 vs 21 and 22 predictions

Lowest cost months

Easter, August, Christmas

Highest cost months

Mar-Apr, May-Jun, Oct-Nov

The Spanish media advertising landscape

- There are 2 large sales-houses in Spain; Mediaset (covering the main commercial channels; 5, Cuatro etc) & Atres Media, with 57% of viewership between then. However, smaller sales-houses tend to offer cost-efficient opportunities. ‘Pulsa’ provides packages across a collection of reality/niche stations, whilst airtime on sales-houses like ‘Movistar’ (collection of smaller-mid reach stations mainly covering drama, series and movies) is bought on a cost-per-spot basis – meaning rates are fixed (advantageous particularly during periods of high viewership, when relative CPTs are decreased).

- 224 total TV stations including regional & public stations – Spain has the fourth-highest number of stations in Europe, allowing a competitive, low-price landscape and greater opportunities to target and optimise.

- Booking deadlines tend to be roughly 3-4 weeks in advance and are fairly flexible. There is potential for late deals, particularly during under-invested periods (e.g Easter, post-Christmas, lockdowns), significantly driving down pricing.

- Seasonal trends are primarily in line with other markets – cheaper post-Christmas and during the summer. There are additional opportunities for DRTV advertisers around Easter, where pricing drops below post-Christmas levels – often balancing out any potential decrease in response.

- Creative is approved through ‘Autocontrol’ and takes 3-4 weeks to clear It is mainly only used for heavily regulated sectors like finance and gambling, regulations are similar to Clearcast in the UK.

All Response Media delivered a TV and media advertising response in Spain

One advertiser saw CPAs decrease by almost -50% during the last month on air, compared to launch in January 2021. Another advertiser saw CPAs decrease by an impressive -70% between launch in January 2021 and their most recent campaign this summer.

Both case studies are testament to the agency’s ability to effectively create, learn and optimise plans in the region, and internationally, to help brands make smarter business decisions.

Spain has become an essential and lucrative market for client media planning and spending.

FEATURED READS

All Response Media Viewpoint

Using advanced international data expertise and strategy to identify market conditions that deliver optimal TV and media advertising results is essential when testing or expanding internationally.

If your business is active in European markets, or you are considering expanding, take a market and media neutral approach. This allows you to fully assess the market as it stands, recommending plans that exploit nuances, enhancing efficiency, testing and learning to improve results and scale your business.

All Response Media run advertising campaigns across Europe through our Amsterdam offices, including high-potential markets like Spain.

Spanish TV and media advertising: Spain is a market that combines low pricing, a significant population and a DRTV-friendly TV buying landscape. Use package buys to push down price and have a high potential for optimisation.