University advertising report

Contents:

- 1 – Key dates, web visits and ad budget trends

- 2- Industry advertising investment by media channels

- 3 – Getting granular in regional, TV and digital advertising within the sector

- 4 – Top 10 offline ad spend, university ranking and web visits

Section 2

- 5 – How can university advertisers reach their target market?

- 6 – Broadcaster TV accounts for over 56% of uni audience video advertising

- 7 – BVOD is critical for delivering cost-effective reach for 16-34s

Section 3

- 8 – ATT invested the most in advertising but performed the worst compared to competitors

- 9 – Does loading up ad spend to focus on localised university clearing activity make an impact?

- 10 – Advertising during 2022 clearing and generating ‘buzz’ for 2023’s student intake

SECTION 1

Macro Trends and Insights

Key dates, web visits and ad budget trends

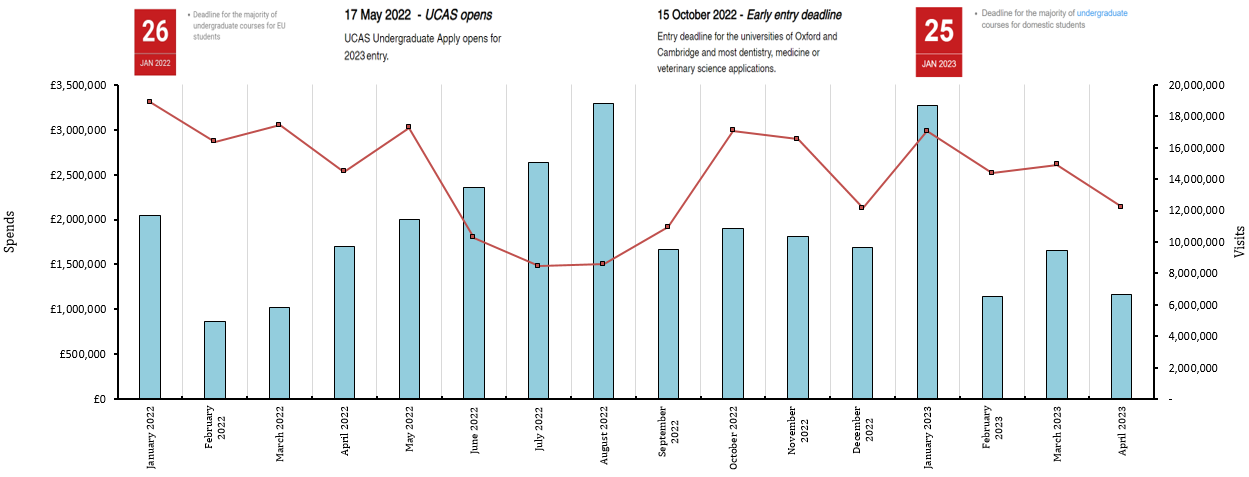

Our latest university advertising report discovers that higher education advertisers traditionally spend the majority of their ad budgets during the summer months, priming applicants for their final year of sixth form, and pupils going through clearing for courses beginning in October.

January also sees a high portion of ad budget allocation in the sector, coinciding with university application deadlines.

University industry advertising investment by media channel

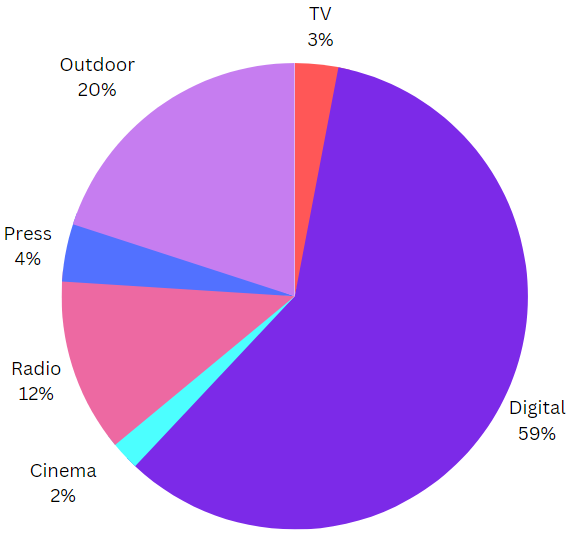

Looking at Jan 22 to April 23, universities invest most of their advertising budgets into Digital channels (Nielsen, 23). Outdoor and Radio are the second and third most favoured media channels for the industry, with TV making up 3% of the spend.

| Media Type | £30.2m Total Spend | % |

| TV | £993k | 3% |

| Digital | £17.8m | 59% |

| Radio | £3.6m | 12% |

| Press | £1.3m | 4% |

| Outdoor | £5.9m | 19% |

| Direct Mail | £64k | 0.2% |

| Cinema | £650k | 2% |

Getting granular in regional, TV and digital advertising within the sector

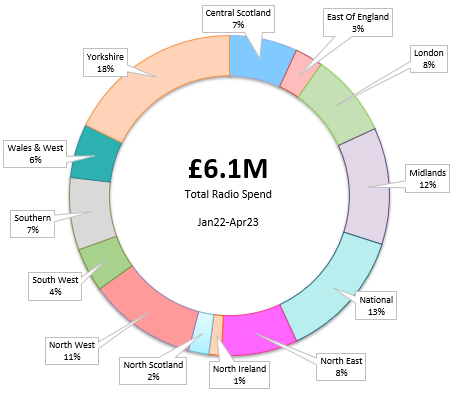

Nationwide, Yorkshire and the Midlands accounted for 45% of total radio spend from January 22 to Aug 2023, with London and the North East tied in 5th accounting for 8% of total spend amongst the 13 regions.

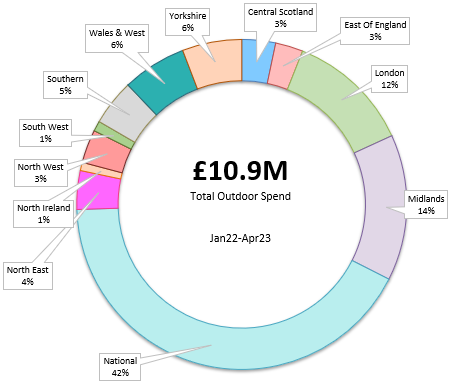

Outdoor spend was rolled-out primarily as nationwide camapigns for the industry, with the Midlands and London the next two focus areas for OOH advertising in the sector.

Top 10 offline ad spend, university ranking and web visits

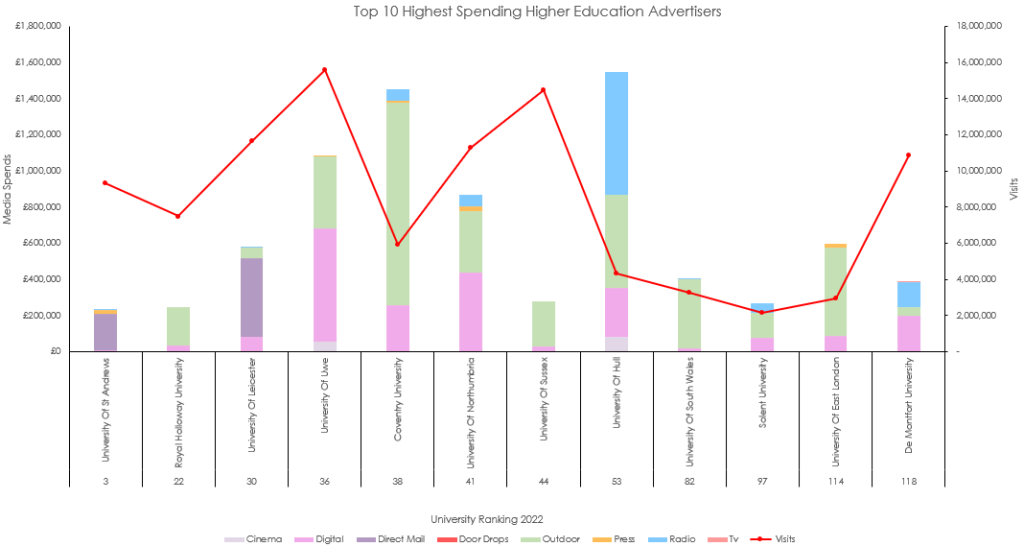

Hull University and Coventry University are two of the biggest spenders on advertising, yet draw some of the least amounts of visitors. On the other hand, UWE, University of Sussex and De Montfort University appear to generate the greatest engagement from their ad spend.

SECTION 2

Media consumption amongst the higher-education target audience

How can university advertisers reach their target market?

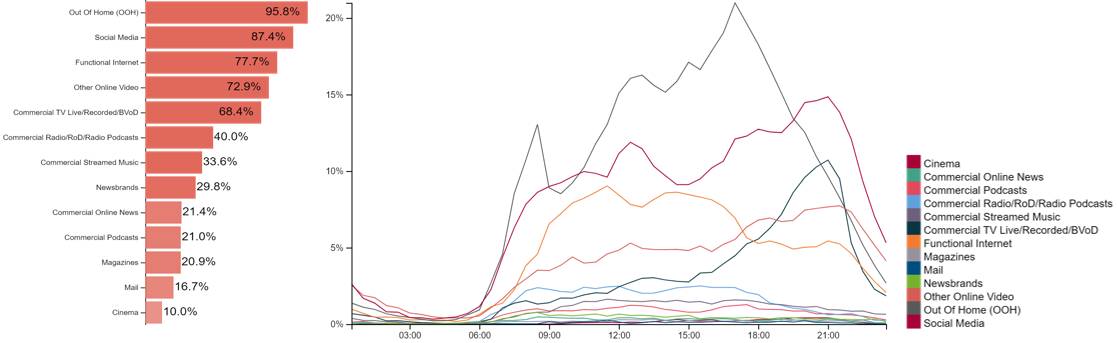

The higher education audience is more digitally focussed, but advertisers can still reach 68% of them across TV and BVOD, with reach peaking at 9pm. Research by IPA Touchpoints found that OOH was the best way to reach the cohort with reach peaking by 5.30pm, coinciding with the findings that OOH ad spend is the second largest source of media investment behind digital in the sector.

16-34 Ads: Commercial Media Timeline

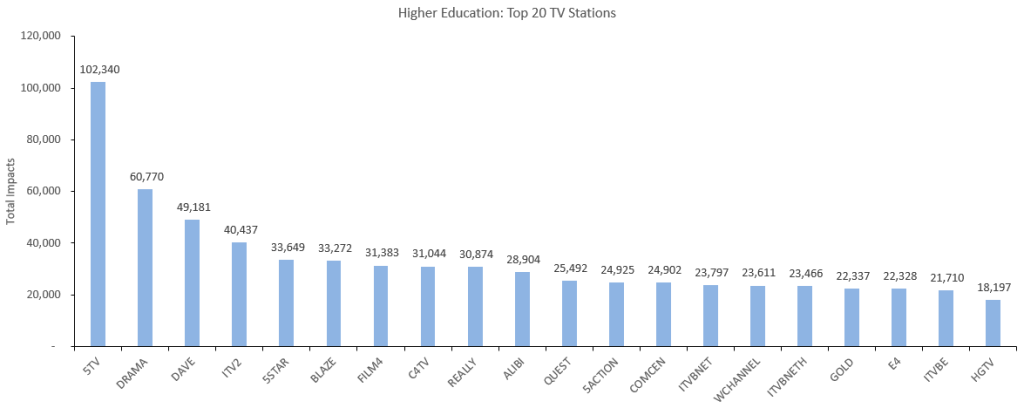

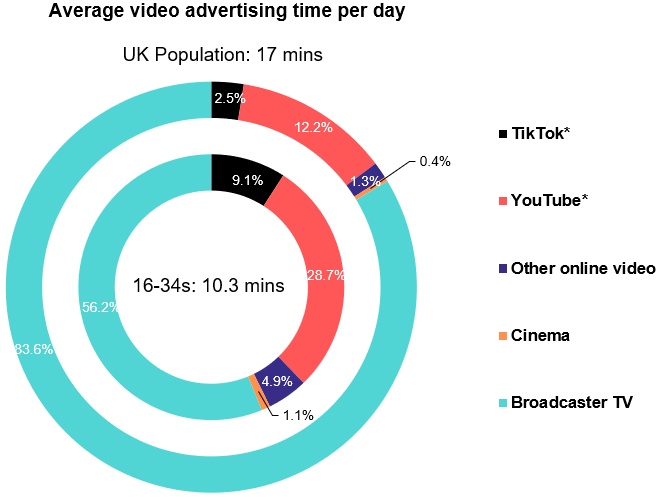

Broadcaster TV accounts for over 56% of uni audience video advertising

Broadcaster TV still accounts for over 56% of the university audience’s video advertising. YouTube exposure comes in as the second largest source of time spent amongst 16-34s.

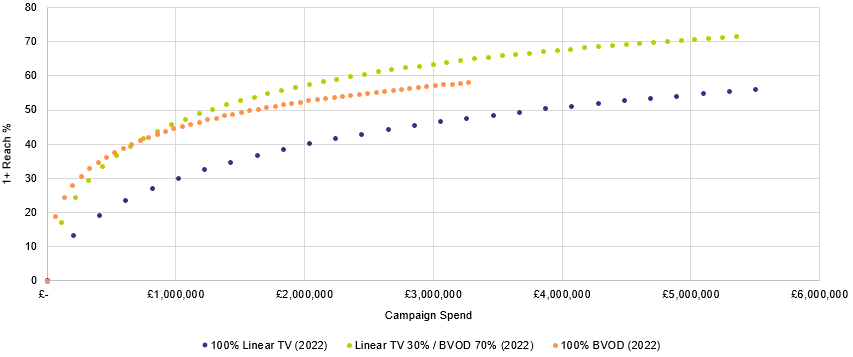

BVOD is critical for delivering cost-effective reach for 16-34s

The higher education target audience skews towards a larger proportion of lighter TV viewers. Amongst these lighter TV viewers, the lightest half consume around 60% of BVoD.

BVoD viewing has been steadily growing over the last decade, especially amongst younger audiences. Over time, it has brought clarity on the contribution it makes alongside linear TV. When paired up with the right programming for your target audience, advertisers can experience an incremental reach gain of up to 11% weekly amongst 16-34s (IPA Touchpoints 2017-2022).

SECTION 3

Media Advertising Deep-dive

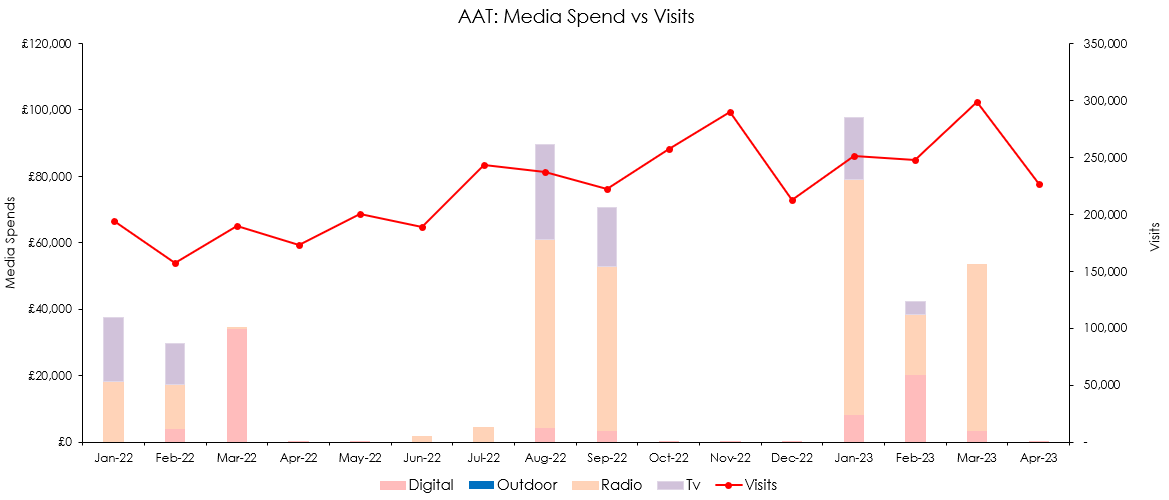

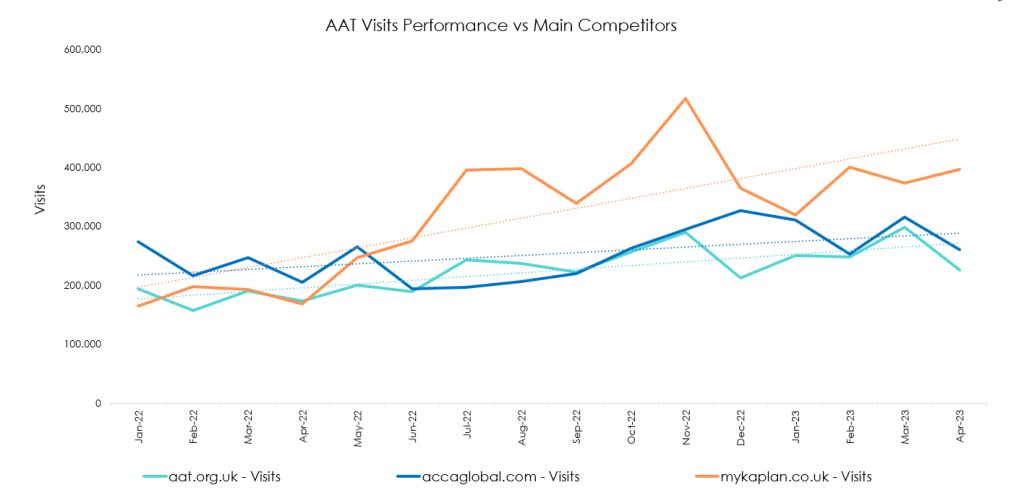

ATT invested the most in advertising but performed the worst compared to competitors

Accounting qualification providers seeing positive trends. ATT is the only body amongst its competitors that advertises extensively in a range of media channels. AAT’s advertising did seem to encourage visits during a summer period when the higher education sector sees its lowest engagement.

However, when comparing against their competitor set, they perform the worst at driving visits to their website.

Does loading up ad spend to focus on localised university clearing activity make an impact?

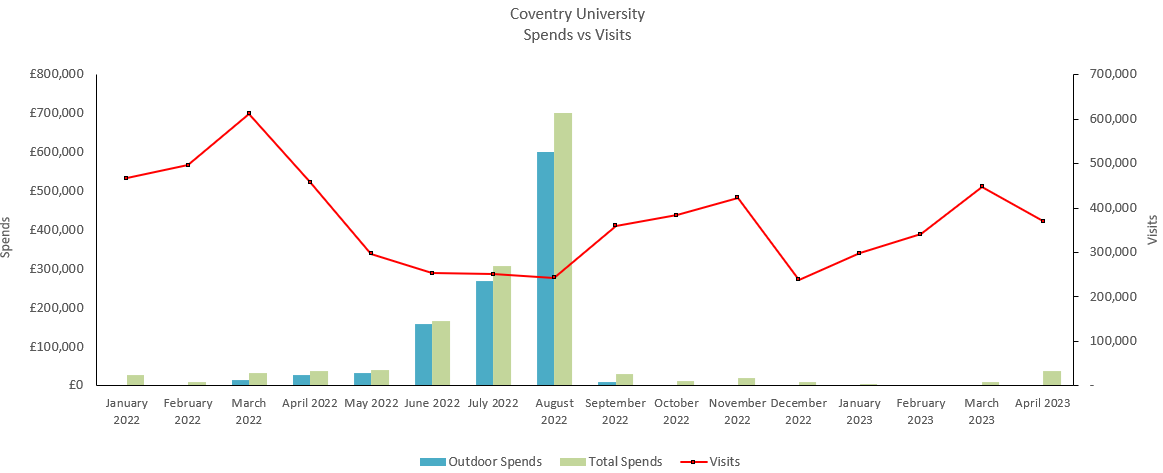

As we outlined in section one, peak summer months are least efficient at driving traffic to the industry. The University of Coventry was unable to generate a significant lift in web traffic despite reportedly spending c. £1m between June 22 and August 22.

The university spent 77% of its total ad budget on outdoor advertising, choosing to market to pupils in and around Birmingham.

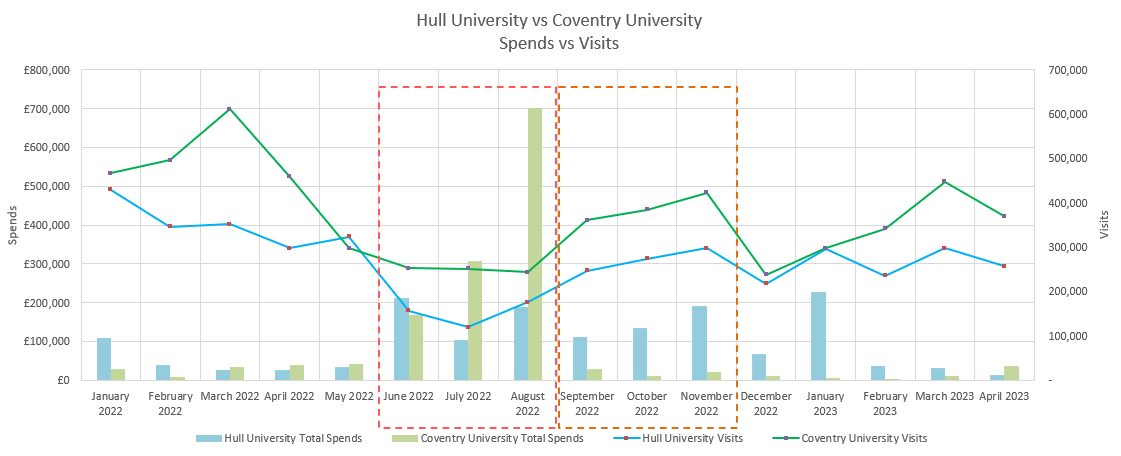

Advertising during the clearing period worked better for Coventry University. We must acknowledge that Coventry did spend 60% more than Hull University, and that they rank 15 positions higher in the university rankings.

When looking at September 22 to Jan 22 months, we can see that Coventry invests significantly more than Hull in rolling out ads at the beginning and throughout the application process for September 2023 start dates.

Advertising during 2022 clearing and generating ‘buzz’ for 2023’s student intake

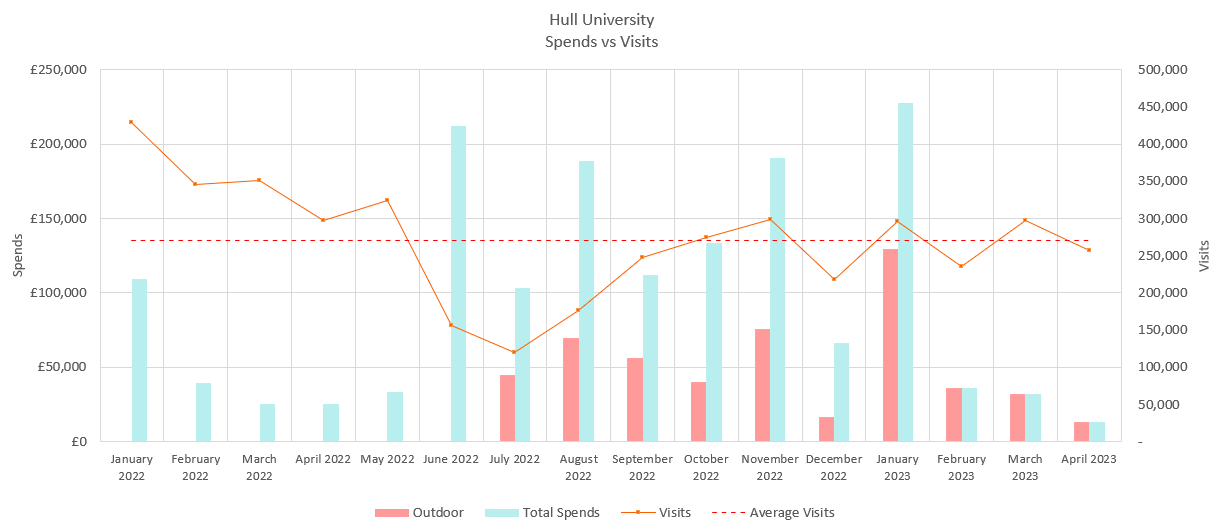

During the summer months, Hull University rolled out an OOH campaign around London to prepare for pupils enrolling in the clearing process. Although outdoor advertising accounted for 33% of their overall ad budget, even when combined with radio ads, they were unable to significantly increase visitation throughout the summer – a common feat throughout the industry.

Get in touch today

Get a second opinion on your advertising investment. Find out how Europe’s largest performance marketing agency can combine data science with TV, digital and offline advertising expertise to drive business performance.

"*" indicates required fields

Our team is happy to answer your media questions

Fill out the form and we’ll be in touch as soon as possible.

"*" indicates required fields